A V-Shaped Recovery in the Property Market

After a challenging 2020 with a lockdown on the economy, 2021 promises to be a year of recovery. The adverse impact of the COVID-19 pandemic was felt sorely on the national economy and property market in 2020. However, with developers adapting to the changing business environment, we are seeing a recovery in the national economy and property market, at least in the first half of 2021. In the current financial climate, it is an ideal time to invest in a home, as financing terms are very attractive currently.

Recovery in the national economy and property market

The national economy and property market is currently experiencing a strong recovery after a drastic decline in the previous year. According to the Valuation and Property Services Department’s Property Market Report H1 2021, Malaysia’s Gross Domestic Product (GDP) growth improved to 16.1% in Q2 2021 after four consecutive quarters of contraction. However, the strong growth for this quarter was also attributed to the low base recorded from the significant decline in Q2 2020 (-17.2%). The economic performance was supported mainly by the improvement in domestic demand and continued robust exports performance.

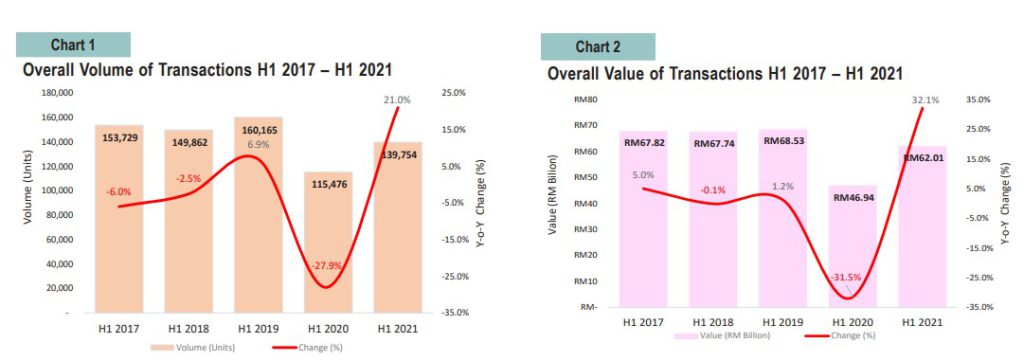

On a similar track to the country’s economic growth, the property market performance recorded a significant increase in the first half of 2021 (H1 2021) as compared to the same period last year (H1 2020). A total of 139,754 transactions worth RM62.01bil was recorded, showing an increase of 21.0% in volume and 32.1% in value compared to the same period last year. Based on these developments, we are seeing a V-shaped recovery in the national economy and property market.

Correspondingly, an improvement in the residential property sub-sector took place. There were 92,017 transactions worth RM34.51bil recorded in the review period, increased by 22.2% in volume and 34.7% in value year-on-year. Performance across the states improved in the review period. All states recorded higher market volume except for WP Putrajaya. The four major states, namely WP Kuala Lumpur, Selangor, Johor, and Pulau Pinang recorded an increase of 19.8%, 38.0%, 4.8%, and 41.3% respectively.

Recovery in the primary market

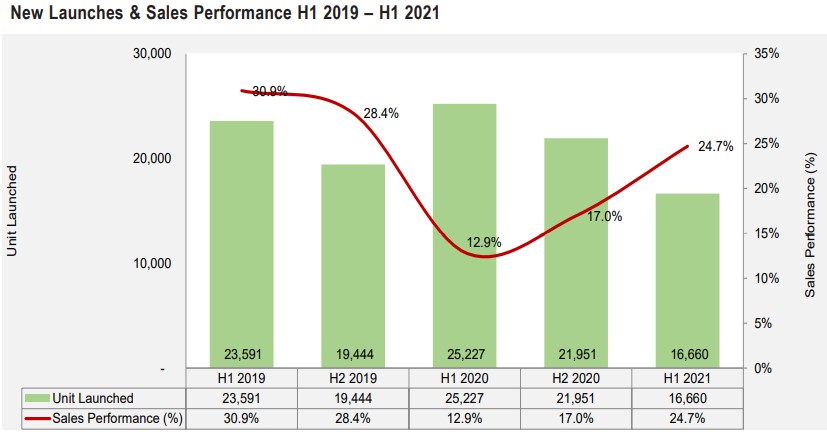

In the primary market, the number of new launches in the first half-year were far behind those recorded in similar half of 2020. There were 16,660 units launched, down by 34.0% against 25,227 units (revised) in H1 2020. Against H2 2020, the new launches were lower by 24.1% (H2 2020: 21,951 units).

Sales performance for new launches recorded at 24.7%, better compared to H1 2020 (revised 12.9%) and H2 2020 (17.0%). The improvement in sales performance probably attributed to various measures by the government, such as incentives of the Home Ownership Campaign (reintroduced from Jun 1, 2020 to Dec 31, 2021) and low Overnight Policy Rate (OPR).

The property market recovery is supported by a favorable monetary policy by the central bank. The OPR was reduced to 1.75% in July 2020, and has remained unchanged since then until Sept 2021. The low OPR means low costs for borrowing or refinancing an existing home loan that could help to stimulate the property market.

Encouraging home ownership through policymaking

The government has introduced various policies that encourage home ownership, such as the home ownership campaign and a Housing Credit Guarantee Scheme. The Home Ownership Campaign, which is valid till Dec 31, 2021, grants stamp duty exemption for the purchase of residential units for Sales and Purchase agreements executed between June 1, 2020 to Dec 31, 2021. A minimum of 10% discount (from property price) is applicable to all units that are not subjected to government price control.

In the recent Budget 2022 announcement, the government has proposed a Housing Credit Guarantee Scheme. Given the lack of fixed income records for gig workers, small business owners, farmers, and perhaps employees who receive a substantial income through variable elements, such as commissions, they would face challenges in securing a housing loan, even if they have the capacity to repay their loans. Therefore, this scheme could help this group to achieve their dream of home ownership for themselves and their loved ones.

In a related development to property market policies, the Government will not impose Real Property Gains Tax (RPGT) from the disposal of real property in the 6th year onwards. This could help encourage long-term investment in property. At the same time, RPGT would still retain its influence as a financial instrument that discourages short-term speculation in properties.

According to The Edge Markets, REHDA president Datuk Soam Heng Choon said that the association appreciates that the government has considered its proposal to abolish the real property gains tax (RPGT) on homes disposed of from the sixth year onwards by Malaysians and permanent residents in the country. He added that the tax was initially introduced to curb speculation amid a buoyant property market, but given the current softer conditions, REHDA welcomes its removal. “We hope that this measure will help invigorate our property market to make it more resilient and eventually translate into a positive multiplier effect on the economy,” Soam said.

In conclusion, a recovery of the national economy and property market is favorable to the property sector. With favorable monetary policy and real estate policies supportive of home ownership and long-term property investment, it is an ideal time to invest in a home.

Mak Academy principal Mak Kum Shi is a Master of English Studies and a trainer in English, Communications, and Real Estate. As an internationally renowned writer, he has an extensive cover story portfolio on property, entrepreneurship, information communications technology, lifestyle, architecture, and interior design. Learn about English, Communications, and Real Estate by visiting https://makacademy.asia/

Related Blogs